Managing money is hard, from the inflation ridden state of the world to the subscriptions you did not even remember you had, and the constant temptation of shopping online. However, the proper budgeting app can become the difference maker. Whether you are looking to save up for something big, pay down debt, or just get your spending habits under control, there are budgeting apps to suit your needs.

Here, we analyze the best budgeting apps to assist you in making the right, well informed decision.

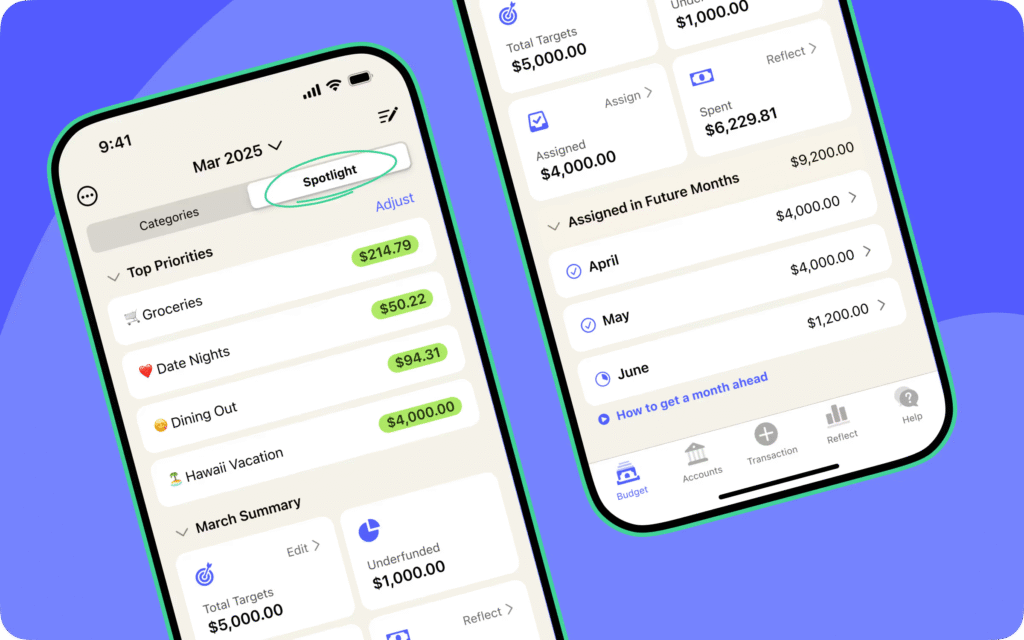

1. YNAB

Optimal for: Active budgeting and money awareness

YNAB is more than just a budget application it is a philosophy of budgeting. YNAB helps users assign each dollar an obligation, allowing them to become mindful spenders. YNAB is good at teaching people to live off last month’s money and get financially ahead.

Pros:

- Real time syncing with bank accounts

- Outstanding finance education and guidance

- Excellent for developing long term money habits

Cons: - Monthly subscription rate of $14.99/month or $99/year

- It does not get to you right away

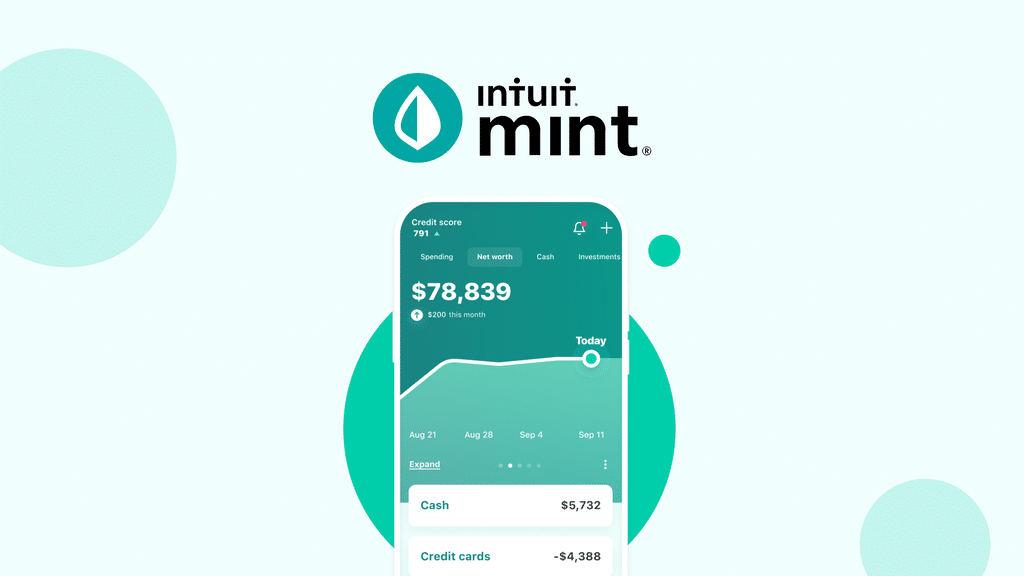

2. Mint

Ideal for: Newbies and hands off users

The long time favorite Mint officially joined forces with Credit Karma back in 2024. The new service maintains most of Mint’s budget and credit score functions but includes loan recommendations, net worth monitoring, and personalized advice.

Pros:

- Free to use

- Automatic transaction monitoring

- Credit score monitoring

Cons: - Advertisements and suggestions for finance products

- Fewer manual adjustments compared to other tools

3. PocketGuard

deal for: Instantly knowing what you have spent

PocketGuard budgeting apps enables you to see what you can spend safely without going over your budget. PocketGuard is famous for its “In My Pocket” functionality, where it determines your discretionary income after deducting bills, savings targets, and essentials.

Pros:

- Graphics and charts simplify budgeting

- Great for people who overspend

- Robust bank synchronization features

Cons: - Fewer detailed budget categories

- Limited investment monitoring

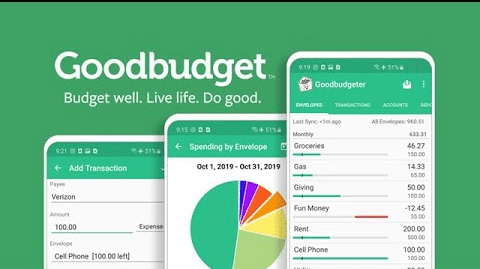

4. Goodbudget

Ideal for: Envelope style budgeting

Goodbudget employs the envelope budgeting strategy albeit with an electronic twist. You divide your money among various envelopes manually and monitor your spend across them.

Pros:

- Strong for couples or families on the same budget

- Promotes responsible spending behavior

- Syncs across several devices

Cons: - It does not link directly to bank accounts

- Manual input needed

5. EveryDollar

Ideal for: Dave Ramsey enthusiasts and zero based budgets

Developed by Ramsey Solutions, EveryDollar is guided by the zero based budgeting system where all the money you bring home gets allocated to something. The free version has you input entries manually, but the paid version syncs transactions automatically.

Pros:

- Clean, simple interface

- Developed around time tested budget planning tactics

- Integrated with the Baby Steps financial plan

Cons: - Premium version is comparatively pricey

- Primarily geared towards U.S. users

6. Monarch Money

Ideal for: Advanced money management and net worth monitoring

Monarch Money provides an integrated picture of your finances with budget, net worth, cash flow projections, and joint financial planning. Perfect for individuals and couples who need long term visibility.

Pros:

- Rich financial dashboards

- Mutual access to partners

- Incorporate investment and debt tracking

Cons: - $14.99/month (or $99.99/year)

- May be too elaborate for simple users

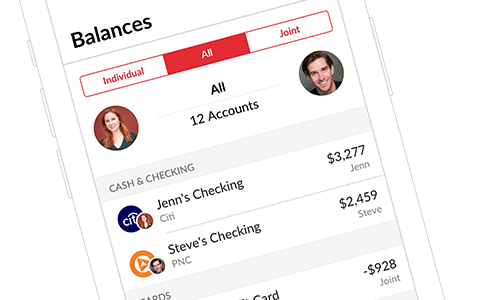

7. Honeydue

Suitable for: Couples who handle finances jointly

Honeydue is aimed at couples who wish to budget, track spending, and save together. Honeydue allows each to decide what they wish to share, therefore being an ideal solution for money transparency without complete exposure.

Pros:

- Joint expense tracking

- Bill reminders and notifications

- Personalizable categories

Cons: - No strong desktop interface

- Advertisements in the free version

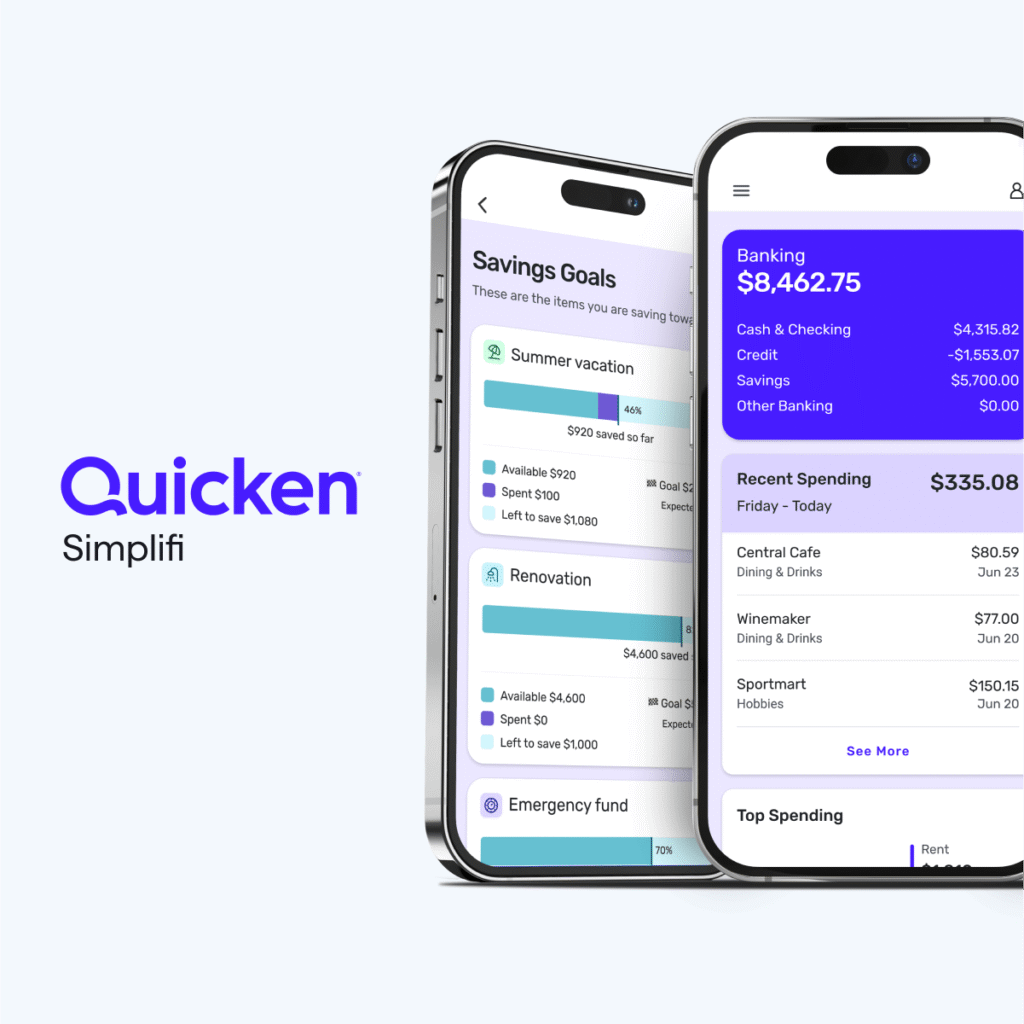

8. Simplifi by Quicken

Ideal for: Clean appearance and individualized customization

Simplifi provides the contemporary alternative to the conventional desktop software offered by Quicken. With live updated projections for cash flow and watchlists for spending, it is ideal for those who need detailed control of each dollar.

Pros:

- Aesthetic and elegantly crafted

- Effective for short term budget planning and long term goal achievement

- Excellent mobile experience

Cons: - Costs $5.99/month or $47.99/year

- No free version

9. Zeta Money Manager

Ideal for: Contemporary families and budget planning for two

Zeta is another solid choice for families, couples, and roommates who need to split bills. It allows you to merge individual and joint money while maintaining personal controls over what others see.

Pros:

- Ideal for shared finances and modern families

- Tracks overall wealth and objectives

- Free to use

Cons: - Still expanding; fewer integrations compared to larger names

- Limited Investment Tracking

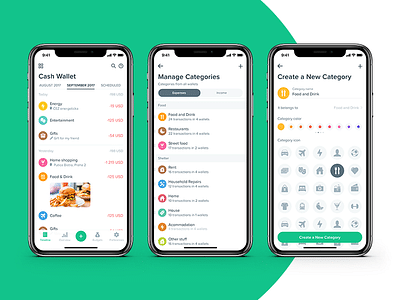

10. Spendee

Ideal for: Visual learners and personalized categories

Spendee combines fantastic design with strong features to enable you to build several wallets for various budgetary reasons such as holiday, travel, or joint finances. It is vibrant and visually oriented, so budgeting is no longer scary.

Pros:

- Supports several currencies

- Excellent for visualizing spending

- Well suited for visitors or freelancers

Cons: - Some advanced features behind the paywall

- Manual input required for complete personalization

How to Select the Best Budgeting App?

Not all budgeting apps are the same. The best budget app for you depends on:

- Your objectives: Are you looking to pay off debt, save for travel, or simply get your regular spending under control?

- Your style: How much automation are you interested in having, versus hands on control?

- Your tech comfort: Some tools require a learning curve, while others are plug and play.

Make use of free trials or free versions to try out several before you commit.

Read the following blog to understand Budget Planning.

10 Budget Planning Tips for Beginners

conclusion:

You should not find budgeting to be time consuming or stressful. Thanks to the right app, you can gain control of your money, stay away from surprises, and even have fun while doing it. Whether you are new to budgeting or an expert, there is something on this list to suit your needs.