I used to believe that people were either naturally good with money or they simply were not. Some of us grew up learning how to save and manage expenses, while others, like me and perhaps you, did not receive that kind of guidance. Let’s face it: discussing money can feel uncomfortable, especially if your finances are not where you want them to be.

But here is the truth: most people do not realize you do not have to be great with money to start improving your financial life. Building strong financial habits is not about being perfect. It is about starting where you are, making small changes, and sticking with them over time.

If you have ever felt stuck, overwhelmed, or confused about financial habits, this guide is for you.

Why Financial Habits Are So Important?

We hear the phrase “good financial habits” all the time, but what does that really mean?

It is not about being a finance expert or living on rice and beans. It is about making consistent, healthy decisions with your money day after day that move you toward stability and freedom.

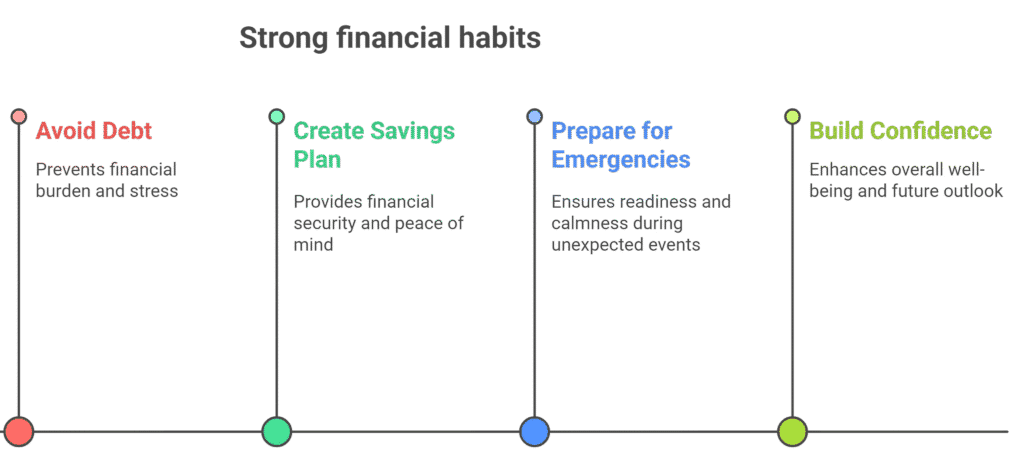

Strong financial habits help you:

Even small habits, like checking your account balance or avoiding impulse purchases, can make a huge difference over time.

1: Be Honest With Yourself About Your Spending

One of the hardest but most important steps is getting honest about where your money is going.

It is easy to swipe a card and not think about it. But those little daily expenses? They add up fast. A few takeout meals, random Amazon buys, or unused subscriptions can quietly drain your income.

What to do:

Spend the next 30 days tracking every expense. You can use a notebook, an app like PocketGuard, or even just the notes app on your phone. Write it all down, no judgment.

You will probably be surprised by what you find, and that awareness is the first step toward change.

2: Set Clear, Personal Goals

It is hard to stick to any habit when you do not know what you are working toward. So instead of vague ideas like “I want to save more,” get specific.

Ask yourself:

- What do I want to change about my financial situation?

- What would make me feel more secure?

- What short-term goal could I hit in the next 3–6 months?

Examples:

- Save $500 in an emergency fund

- Pay off one credit card

- Start putting $50/month into a savings account

Tip:

Write your goals down and keep them visible on your fridge, in your planner, or set as a phone reminder.

3: Make a Simple Budget

Let’s be honest: the word “budget” does not excite most people. But think of it this way, a budget is just a plan for your money.

It does not need to be complicated. The simpler it is, the more likely you are to stick with it.

Here are a couple of easy methods:

- 50/30/20 Rule: Spend 50% on needs, 30% on wants, and 20% on savings or debt.

- The Envelope Method: Use actual envelopes (or digital versions) for categories like groceries, gas, and entertainment.

Pro tip:

Pick one method, try it for a month, and adjust as needed. Budgeting is a skill, not a one-size-fits-all formula. Want to make things even easier? Check out our full guide on Budgeting Apps to Take Control of Your Finances for tools that do the heavy lifting for you.

4: Automate Whatever You Can

Life gets busy. The more you can automate your finances, the fewer decisions you will have to make and the less likely you are to forget or fall behind.

Start by automating:

- Transfers to savings (even $10 a week is a win)

- Bill payments

- Retirement or investment contributions (if applicable)

Set it and forget it. Then watch your savings grow quietly in the background.

5: Build a Small Emergency Fund

Unexpected expenses are not “if,” they are when. Your car will need repairs. You might face a medical bill or job loss. Having an emergency fund means you do not have to panic when life throws a curveball.

Start small. Even $500 is a great first target. Once that is in place, aim for 3–6 months’ worth of essential expenses.

Quick tip:

Keep your emergency savings in a separate, easy-to-access account, not in your checking account, where you might be tempted to spend it.

6: Cut the Financial Noise

Sometimes we get overwhelmed simply because our financial lives are too messy multiple bank accounts, five credit cards, and bills coming from every direction.

Simplify where you can:

- Close old or unused accounts

- Cancel subscriptions you forgot you had

- Set one or two days a month to review everything

The less clutter you have, the easier it becomes to stay on top of things.

7: Surround Yourself with Money-Smart People (or Content)

You do not need to go through this journey alone. One of the best ways to change your financial habits is to change what you are exposed to every day.

Follow creators or blogs that talk about personal finance in a way that makes sense to you. Listen to podcasts while doing dishes. Read stories from people who’ve paid off debt or built savings from nothing.

Some beginner-friendly resources to check out:

- The Budget Mom on YouTube

- The Dave Ramsey Show (for debt-free advice)

- Mr. Money Mustache’s blog

What you hear often becomes what you believe, and believe it or not, you are capable of financial change.

8: Celebrate Progress, Not Perfection

Do not wait until you are completely debt-free or have six figures in savings to feel good about your progress. Celebrate the small wins.

Did you stick to your grocery budget this month? That is a win. Saved your first $100? Huge. Canceled a subscription and redirected the money to savings? You are doing great.

Every positive step you take adds up, even if it feels small right now.

Final Thoughts:

If managing your finances has always felt like an uphill battle, I hope this gave you a bit of clarity and encouragement. You do not need to overhaul everything overnight. Just choose one step from this list and start there.

With time, consistency, and a little patience, your financial habits will improve and so will your confidence.

Your Opinion Matters – Leave a Review!

What People Are Saying

There are no reviews yet. Be the first one to write one.